How Canadian Traders Can Maximize Market Hours From Coast to Coast

Trading is a game of timing—and for Canadian traders, your time zone can either be a strategic advantage or a frustrating barrier. Whether you live in Vancouver, Toronto, or St. John’s, knowing which time zones align best with the markets you trade is key to maximizing performance, avoiding fatigue, and increasing consistency.

This article explores how your location in Canada impacts your access to the major global markets—U.S., Europe, and Asia—and provides actionable tips to help you build an optimized trading routine from any province.

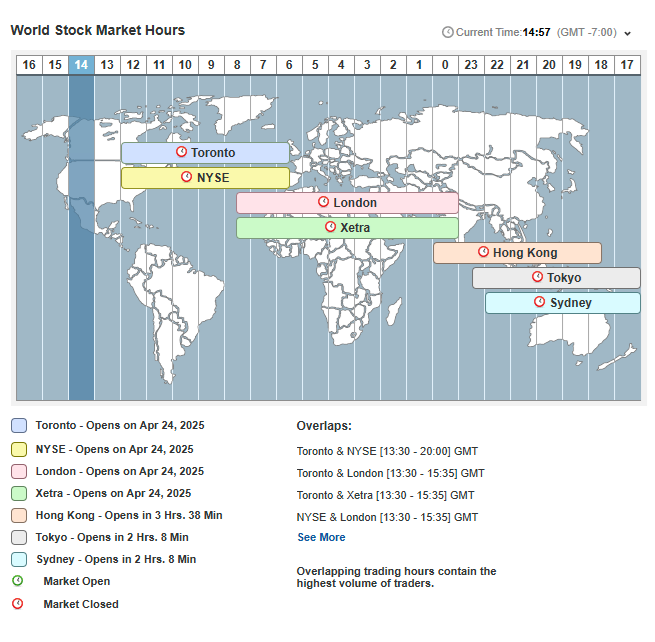

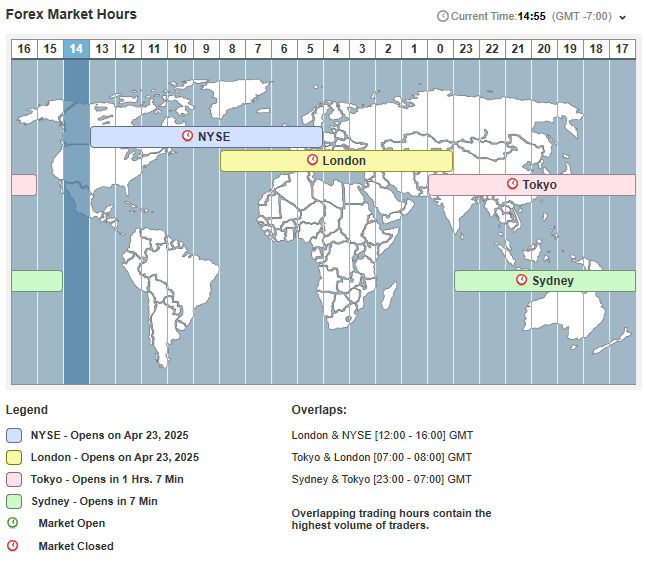

Understanding the Global Market Clock

Before looking at the best time zones, let’s examine the four major trading sessions around the world:

- New York Session (8:00 AM – 5:00 PM EST)

Dominates U.S. equities, options, and a large share of forex volume. - London Session (3:00 AM – 12:00 PM EST)

One of the busiest forex sessions, overlapping briefly with both Asia and New York. - Tokyo Session (7:00 PM – 4:00 AM EST)

Ideal for trading Asian equities, JPY pairs, and some early crypto activity. - Sydney Session (5:00 PM – 2:00 AM EST)

Typically slower, but critical for early forex traders and some futures activity.

All times above are in Eastern Standard Time. Let’s now look at how Canadian traders fit into this global puzzle.

Vancouver (Pacific Time) – A Forex and Asia Market Sweet Spot

Time Zone: Pacific Time (PT)

UTC Offset: UTC -8

For Vancouver-based traders, the Pacific Time Zone offers a few major advantages:

- New York market opens at 6:30 AM local time

Early, but manageable if you’re a disciplined morning trader. - Asian session begins in the evening (around 4:00–5:00 PM PT)

Perfect for part-time traders or those with day jobs. - London overlap requires late-night or early-morning trading

Less ideal unless you’re a night owl or swing trader.

Best Fit: Forex traders, crypto traders, early risers, and evening part-time traders.

Challenges: The London session starts around midnight local time, so if you’re trading European markets, expect late nights or automated strategies.

Calgary & Edmonton (Mountain Time) – A Balanced Middle Ground

Time Zone: Mountain Time (MT)

UTC Offset: UTC -7

For Alberta traders, Mountain Time offers a bit more breathing room in the mornings:

- New York markets open at 7:30 AM MT

You’ll have time for analysis and prep before the bell. - London overlap still falls during late night or early morning

A bit easier to access than from Vancouver, but still challenging for most.

Best Fit: Full-time U.S. equities and futures traders; part-time forex traders with evening flexibility.

Challenges: You’re still catching the Asian session in the afternoon and missing most of the London one unless trading very early.

Toronto & Montreal (Eastern Time) – Prime U.S. Market Access

Time Zone: Eastern Time (ET)

UTC Offset: UTC -5

Toronto is Canada’s financial heart for a reason—this time zone gives traders perfect alignment with the U.S. markets:

- New York opens at 9:30 AM ET

Traders have a full morning to prepare and an ideal daily routine. - London session overlaps early (3:00 AM – 7:00 AM ET)

Challenging unless you’re trading forex full-time or scheduling alerts. - Asian markets open during the night

Not ideal unless you trade crypto or use limit orders in overnight sessions.

Best Fit: Stock, options, and futures traders who focus on U.S. markets.

Challenges: Forex traders targeting the London session may need to adjust sleep schedules or trade via alerts and automation.

Halifax & St. John’s – An Edge in the East

Time Zone: Atlantic Time (AT) / Newfoundland Time

UTC Offset: UTC -4 / UTC -3:30

Traders on Canada’s east coast gain early access to London and even Tokyo sessions, making these regions interesting for forex specialists.

- New York markets open at 10:30 AM (AT)

Gives more morning prep time. - London session runs from 4:00 AM to 11:00 AM (AT)

Better access to European volatility compared to Western Canada.

Best Fit: Forex and swing traders, especially those targeting EUR and GBP pairs.

Challenges: U.S. market activity occurs later in the day, which may not fit all schedules.

Matching Time Zones to Trading Style

The best time zone for you depends less on geography and more on your strategy and schedule. Here’s how it breaks down:

- Scalping & Intraday Trading: Choose a time zone that aligns with the market’s opening hours (ET or MT is best for U.S. equities).

- Swing & Position Trading: Time zone matters less; focus on market opens and closes for daily/weekly chart analysis.

- Part-Time Trading: Pacific and Mountain time zones allow for evening access to Asia and U.S. pre-market sessions.

Practical Tips for Time Zone Optimization

If you want to make the most of your trading hours, follow these tips:

- Use Market Session Clocks or World Clocks built into platforms like MetaTrader or TradingView to track volatility windows.

- Keep a consistent routine, even on weekends, to train your body and mind for peak performance.

- Schedule alerts during your off-hours to monitor key levels or trade setups.

- Automate with conditional orders if you can’t be online for overlapping sessions.

- Keep a trading journal with time stamps—see when you perform best relative to your time zone.

Final Thoughts

Canada’s geography spans six time zones, which means trading schedules vary widely by province. Whether you’re a morning person on the West Coast or a London-session enthusiast in the Maritimes, aligning your trading activity with market hours can dramatically improve performance and consistency.

At Vancouver Prop Firms, we help traders across Canada understand not just where to trade—but when to trade. With the right timing and a strong trading plan, your location becomes a strategic edge—not a barrier.